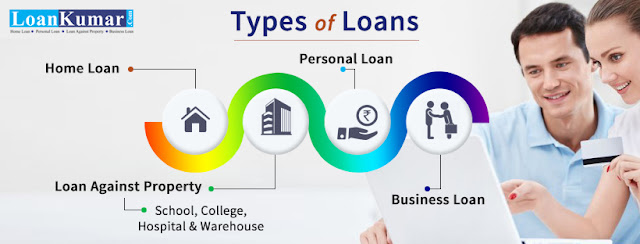

Loan kumar is the best loan provider of business,

personal, home loans & loan against property in Delhi NCR. They are the

best as they have the fastest dispersal time and do no waste time in unnecessary

paperwork. Moreover the interest rates are also very competitive and there are

no hidden charges.

These are the reasons why loankumar.com is the best loan

provider online in India:

- QUICK DISPERSAL

With loan kumar which is the best business and personal

loan provider in Delhi NCR, you get quick loan dispersal and you do not have

to wait for days trying to get funds transferred to your account. Everything is

done easily to avail business, personal or home loans by following few easy

step and you can convert your dream into reality.

- MINIMUM PAPERWORK

Loan kumar is the best personal loan provider in Delhi

NCR and does not ask for unnecessary paperwork while applying for loan. If you

meet the requirements then the loan is dispersed to you super quick. The entire

transaction happens online and you get the loan amount credited in your bank

account super quick and easy.

- LOW INTEREST RATES

Loan kumar provides loans at very competitive interest

rates. These interest rates are lower than many other financial lenders in the

market and very competitive and correct. There is no waiting period and the

interest rate is the same and does not change after the loan is dispersed.

There is a complete transparency in the system.

- NO HIDDEN CHARGES

All the charges are stated beforehand and there are no

hidden charges and thus you do not have to suffer financially as many lenders

don’t state the extra charges up front and come out with them only when you

have to pay back the loan. There is no such situation with loan kumar which

is the best loan provider in Delhi NCR.

- SUPPORTIVE TEAM

Online support is provided and you can also call on the

phone number if you have any doubts and queries. The staff is supportive and

professional and they leave no stone unturned to ensure that the loan is

dispersed super quick and also that their customer experiences delight.