All of us have imagined a dream home once

in our lifetime. Pinning all the snapshots from Pinterest can become a reality!

Visions which include penthouses, lawns, or anything such

dreamy aspirations. Now that you’ve dreamt, it’s time to unleash that dream of

you and bring it into reality with the help of Loan Kumar. Get the most

convenient home loan in Delhi.

Loan Kumar offers a one-stop solution to

all your problems related to the purchase of a home. All you need to do is

attain these documents along, and you’re good to go!

•

The completed loan application form is required from the applicant

attached with 3 passport sized photos.

•

ID proof; you can select any one option from the following - Passport,

voter/ID card, PAN, driver’s license.

•

A proof copy to verify your residential address can be given in any one

form – driver’s license, aadhar card, telephone/electricity/water bill.

•

After the necessary documentation comes to the property papers.

• Your account statement is required for the

last six months.

•

If you’ve taken any loan from any of the lenders or banks, then you also

need to show the statements from last one year.

•

Proof of income has to be shown to know whether you are a salaried/non-salaried

applicant.

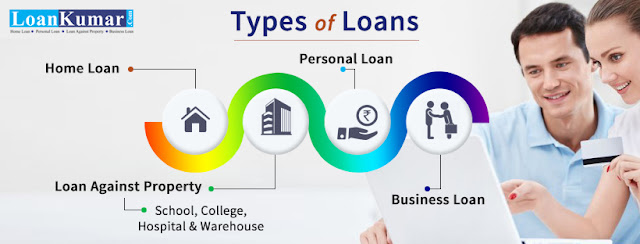

Why

should take a Home loan from Loan Kumar?

1.

Less Paperwork – Quite simple, that’s the mere reason our old customers

keep coming back! We provide fast dispersals of loans without asking for any

unnecessary paperwork.

2.

Low-Interest Rates – Well, there are many lenders and banks that offer

attractive deals. But, we at Loan Kumar, have these lowest interest rates in

the array of the competition.

3.

Repayment Options – We understand that dreams can be a burden, too, at

times. We are a savior for you at your financial crisis.

Get the best home loan in Delhi from Loan Kumar. Visit www.loankumar.com and